How Much Do I Need?

At some point, every person asks, “How much will I need for retirement?” In your 20’s, the question seems absurd and too distant to even be concerned about. And in your 50’s, most people are wishing there were a better way to make up for lost time. Most Americans will not have the luxury of depending on the “security”, that used to be present in Social Security, and will find themselves working longer.

There are a plethora of tools, thoughts, and advice available to help you find out how much money you will need to save for retirement. Historically, the rule of thumb has been to save enough that you will replace about 75% of your working income. As a side note, the crux of our newsletter’s investing strategy is ensuring that the money you’re saving doesn’t get “lost” in major market corrections. The corrections horrific, in the past decade, for many investors who have lost tremendous amounts of money, despite well thought out plans. The end goal for the investor is to manage your money in such a way that you have the right amount to generate the required income, and that it doesn’t get lost along the way.

Caveat Emptor

I will eventually write about some of the caveats of financial planning, but will begin here with Wall Street’s favorite and most ignored quote…

“Past performance is no indication of future results…”

I say that it’s the most ignored quote/hedge because all financial plans rely on a basic assumption of past performance, whether looking at market returns, or risk assumptions. In an effort to appear that they’re not relying on past data, they will run “monte carlo” simulations (using that same historic data). As Darrell Huff said in his 1954 classic, How To Lie With Statistics, “If you torture the data long enough, it will confess to anything.” The reality is that most often plans are used to create a false sense of security–as a selling tool. I submit that planning is important, but significantly less important than actually managing the investments and risk, actively.

How Much Do You Need?

With that in mind, how much do you need to in order to retire comfortably? I’ve included a brief rule of thumb calculation that takes into account the basic variables that should be assumed. Those variables are: beginning age, income, returns and inflation.

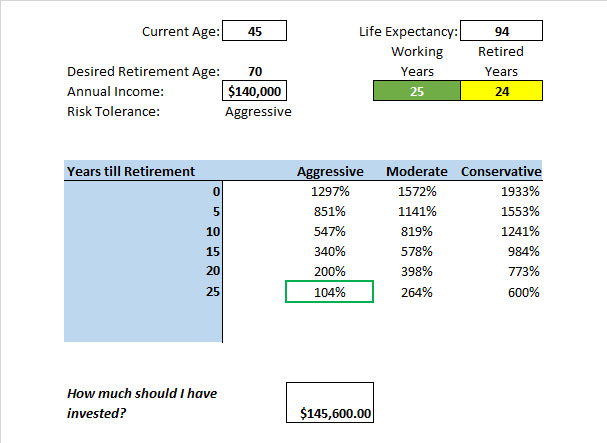

In the above scenario, we’re looking at the needs of a 45 year old who earns $140,000 per year and wants to retire at age 70 (with an assumption that he or she will live to age 94). Current actuarial tables would assume that the average American will not live this long (Here’s a popular life expectancy calculator), but we can look at this individuals family history and lifestyle and make some assumptions.

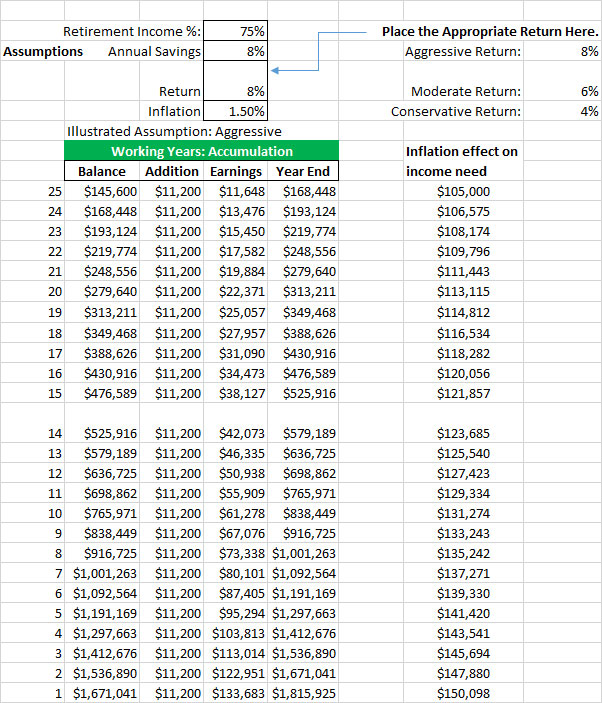

Of course, at some point you realize the entire plan is based on assumptions. We’re also planning that our investor will be saving 8% and is somewhat aggressive and paying attention to his or her investments. With a base inflation rate of 1.5%, and to give us a margin of error, we’re building in the idea that this guy never gets a raise. Which shouldn’t seem too crazy when you take the time to look at price inflation vs. wage inflation over the past 30 years.

Using these assumptions, our investor will spend 25 more years working and 24 years in retirement. He or she should have saved $145,600 by now. This is what being “on-track” looks like.

Does being “on track” really look like this? Can investors still get 8% returns? No, and yes… There really is not a linear investment that only goes up, but even with the variability of investment returns, an average of 8% can be obtained under the right market conditions, strategy and risk management. If you would like to experiment and build your own model, please feel free to use mine as a beginning framework (Retirement Needs Calculator.xlsx)

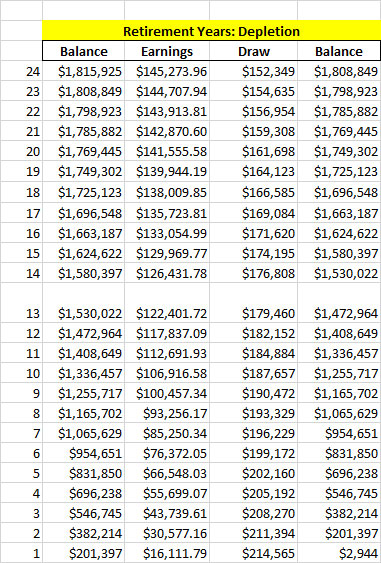

After twenty five years of hard work, our investor is ready to live a life of leisure where nothing goes wrong and faces are always smiling around him/her. The assumptions we use here, during the distribution phase are simply that inflation continues to grow and our base assumption of a 75% need was a pre-tax number. Of course, in the greatest of lucky scenarios, Social Security will also accompany these payments. Also, our investor has chosen not to have a post retirement part-time job or position that will provide additional income.

Hopefully, this exercise proves instructive for you. The charts point to the value of starting early and putting your money at risk. It also should be a good eye opener, if you’ve never actually considered what it “costs” to retire.

If you feel like you’re not prepared, don’t be alarmed, most American’s aren’t and the fact that you’re reading this is indicative that you know it’s a situation that needs to be fixed. Very few Americans have managed to keep their financial lives in order. If you don’t believe me, look at the government reported variance between consumer savings, consumer spending and consumer debt. If you’re dramatically far from your goal, you will most likely have to work longer, but a better option is to ensure your 401k strategy is running on all 12 cylinders and begin to look for additional sources of passive income.