Recently, I was speaking with a Raytheon employee about a simple 401k strategy and the investment options inside his company’s plan. He mentioned that he only invests in the Northern Stock Index, which is an S&P 500 Index fund. He’s been doing this for years because he feels that none of the investment options available to him can outperform the index consistently. This is probably true, but investing only in the S&P 500 doesn’t alleviate his major concern.

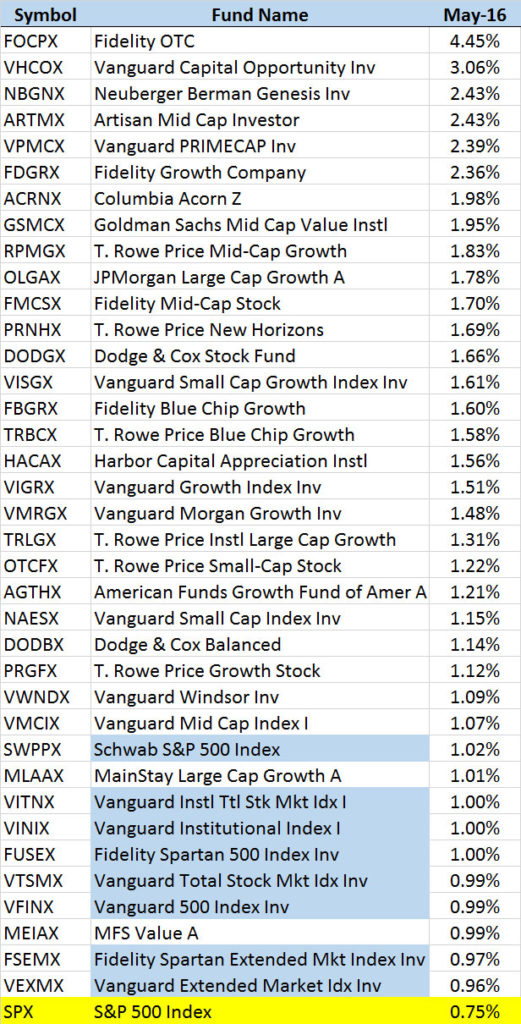

The reality is that the market will probably experience a deep correction before his retirement. After the -49% correction in 2000 and another -56% correction in 2008, his concern is quite legitimate. In May, only 37% of the 100 most widely held mutual funds within 401k’s outperformed the S&P 500; eight of those that did outperform were also index-like funds. Longer term studies suggest that my friend was correct about most funds not beating the S&P 500.

Are there other options in your plan?

The Best 401k Strategy to Manage Risk

- Browse to finance.yahoo.com

- Create a portfolio of your holdings (“My Portfolios”)

- Set Alerts ($ or %)

Mutual funds are priced at the end of the day, so the e-mail alerts you receive will be in the evening. This will give you an opportunity to re-position your account the next morning when necessary. If you’re selecting your funds correctly, your alerts should be few and far between, meaning fewer transactions. You should place a “stop”(sell alert) that you’re comfortable with (maybe 9%) below your initial purchase price. This will allow some “breathing room” for normal market volatility. On a monthly basis, you should raise that stop/alert as the price moves up. When the market does eventually crash again, your retirement money won’t crash with it.

Do you actively manage your 401(k)? Tell us about your buy and sell discipline- How do you manage risk?