The American Benefits Council reported recently that 401k participation rates are at all-time highs. Not so many years ago, participation was near 60% of eligible employees nationwide, an incredibly low number. Recent surveys suggest participation rates are near 91%. However, with the employee’s contribution (and growth) growing tax deferred and often matched by your employer it would be reasonable to expect 100% participation. Historically for many, plans seemed too complex and daunting for younger investors. In addition, younger workers saw retirement as something in the distant future and once placed a lower priority on saving in general.

The tide is turning according to Jean Young of Vanguard, who reports “Millennials are the first generation to potentially be subjected to automatic enrollment 401k’s throughout their working careers.” Thanks to the Pension Protection Act of 2006, automatic enrollment has helped change the investing habits of a generation.

The Best First Investment

As a general investment principle, your first and best investment is always in yourself. Investing in any type of education that can help increase your income or cashflow should make a certain amount of sense. Education is something that cannot be taken from you or ‘lost’ in the market. Income is clearly linked with education and skill in the private sector. The greater your skill or added value, the greater your income. It is from our excess income that we invest… more is better.

Initially when I give this advice, the response is sometimes “I don’t want a master’s degree, it wouldn’t benefit me…” But formal education isn’t always the answer, if you’re a salesman for instance, there are many incredible seminars that are highly likely to help you increase your income. Virtually every profession offers specialized training that will help hone your skills and increase your income.

Magical Compound Interest

Maybe you’re convinced about increasing your income, but you struggle with the idea of investing from, or “risking” your money in the market? You’re asking yourself “Why should I participate in our 401k plan?”

According to the Wall Street Journal, when Albert Einstein was asked, “What do you, Mr. Einstein, consider to be man’s greatest invention?” He didn’t reply the wheel or the lever. He is reported to have said, “Compound interest.”

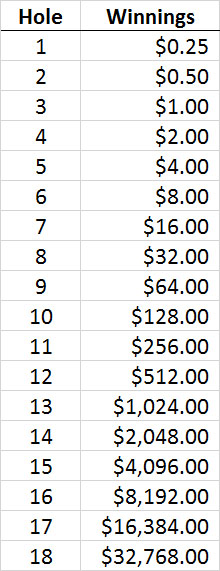

For savers, there’s an incredible benefit to starting early. If your investment is managed well, the work done in just a few years can be incredible. Consider a golf game between two friends, where they wager a simple bet of $0.25 per hole on an 18-hole course. After losing the first hole, one friend decides to go double or nothing for the remaining holes. It’s only a quarter, how expensive could the game get?

Now that’s an expensive game of golf! Hopefully, this game does a decent job of illustrating two points. First, it illustrates the power of compounding. Second, the danger of using a Martingale strategy to manage risk. A more realistic comparison to investing can be made by using actual historic market returns. Of course, past performance is not indicative of future results. In spite of this, it can help manage your expectations on some level. If you have a decent risk management strategy, your results can be much better. While there is clearly a greater benefit to early savers, the tax deferral and matching are compelling enough to even attract late savers. In summary, after you’ve invested in your career, invest in your retirement and do so as early as possible.

Are you participating in your company’s 401k plan? What are some of your challenges?