“Oh my God, Oh my God!!! These markets are in turmoil!!! EVERYTHING is CRASHING Today!!!” This wild overreaction was captured from a random news personality on a random financial news station Friday after the market responded to the British vote to depart the European Union (BREXIT). This crescendo of fear has been orchestrated with the same type of buildup as Y2K.

Aside from the politics of freedom vs. perceived safety, this is a great time to examine the larger question for investors… “Would media owners try to influence an outcome by curating the news they report?” Errr um, no not that question, but the other one, “How do I manage risk in my portfolio when everything seems to be changing so much?”

Primary Defenses against Headline Risk in your 401k

Emotional reaction is the enemy of profitable investing. Unfortunately, much of the media we consume, disguised as news, is meant to elicit an emotional reaction. When considering BREXIT, it’s important to know that the UK is approximately the size of Oregon. Further, it only produces 2.3% of Global GDP. While these figures should offer perspective, they should not lead you to believe that a singular event cannot cascade into a larger impact. In this case, a departure of a few of the core EU members who are financing many of the other members. The fact of the matter is that we don’t know… and I will tell you that the analysts don’t know either. The only reasonable methodology centers around price based risk management.

Recently, we covered the topic of risk management as it relates to your 401k plan and investing in general. If you will recall, we talked about:

- The use of an active rules based strategy

- The use of specific price “stops” and alerts

These are going to be your two primary defenses in the market. Your emotions will often deceive you and of course, there are always those who would seek to manipulate your emotions.

Winning All The Time

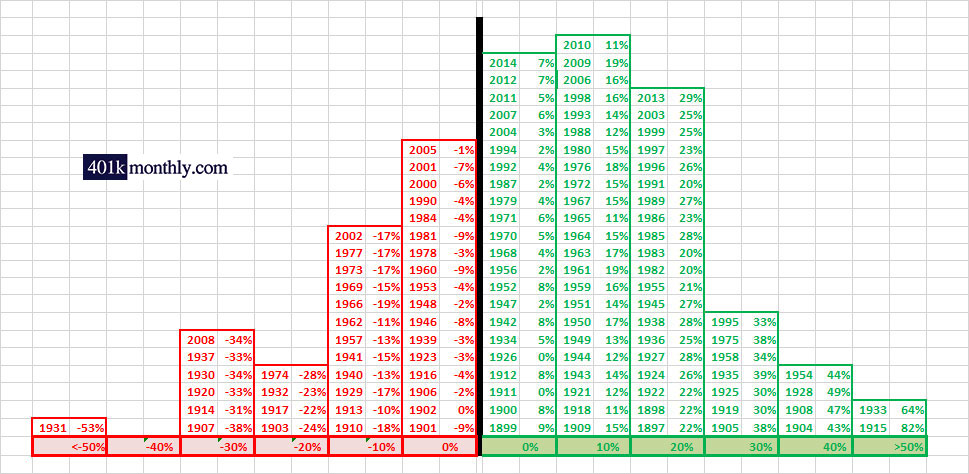

It’s extremely important to understand that regarding the market, there is NO way to win all the time. There is however, a way to win most of the time. You win most of the time by letting the market do the bulk of the work. A simple look at a market distribution curve shows us that the market produces positive results in 66.9% of the years measured. You definitely won’t get those kind of “odds” in Las Vegas.

Of course, our goal is to manage risk. We know that we can’t let the market do all of the work, or we will also completely absorb the volatility that comes to the table as well. What does it look like to “completely” absorb volatility? Well let’s have a look at brief period in 2008 for example:

During this move, the S&P 500 moved from 1576 (on 10/11/07) at its peak to 666.79 (on 3/02/09) at its low, a move of -57.69%. The market didn’t fully recover its 2007 high until April of 2013. Now imagine you’re a 58 year-old who’s watched his/her life savings literally cut in half two months before retirement. Managing risk would have been incredibly helpful here. A simple rules based approach could have prevented major losses and as equally important… helped you sleep better during a crisis.

Have you thought about how to manage risk in your 401k? Share your thoughts on what you think Brexit will ultimately mean to markets.