Our stated purpose is to empower investors toward a better financial future and you cannot be empowered if you’re easily misled by politicians, corporations, or faulty ideas. In such a politically divided time as we now live, among some, criticizing government, or the data it generates, can be seen as an “attack” on one’s party. At the risk of doing so, I’d most like you to understand that the audience we’re trying to reach cover the full spectrum from liberal to conservative and every stretch in between. You may find in life that neither party is telling you the truth, nor do they represent you or have your best interests in mind.

Recently, the Federal Reserve Bank of New York released commentary on completed recent analysis indicating that 15.1% of US households actually have a negative net worth. It’s important to first know that seldom is “research” undertaken at the government level simply for the goal of understanding. It is generally undertaken to support a particular policy or piece of legislation that party leaders are trying to pass. In most cases, the research will easily fit into the party narrative or talking points.

The Fed authors begin with a simple explanation of how negative wealth is calculated and at by the end of the first paragraph offer a partial hint of motive in stating:

“A better understanding of these factors could also prove valuable in explaining and forecasting the persistence of wealth inequality. “

By the time we reach the end of the commentary, we find that the survey referenced only covers about 1,300 US households and offers the following as a final analysis:

“Finally, there has been much discussion about the growth in wealth inequality over the past three decades. Given the importance of student debt in explaining negative household wealth, as seen above, it is likely that the steady growth in student debt and borrowing, combined with the very slow rate of student loan repayment we have documented elsewhere, has materially contributed and will continue to contribute to negative household wealth and wealth inequality.”

Where’s the Real Problem?

Assuming you have not been locked away without news, you may have noticed that under the current administration, much of the propaganda support has been toward dividing the people against one another among various lines, such as race, gender, wealth, etc… It’s perhaps the easiest way to gain political power, but it wreaks a tremendous amount of damage on society. This report continues to lend itself to that objective.

In reading the report, a typical reader would walk away with two thoughts:

- Wealth inequality is a real problem (and the government should do something about it)

- Student Loans are a real problem (and the government should do something about it)

You may notice in most cases, the trend is always toward a government solution. In the latter, the current focus is away from personal responsibility and rests solely on the student loans themselves. Why do you suppose they aren’t examining the reason for high student loan balances? They do mention in their analysis that the reason for high loans are “slow repayment trends”, which can largely be explained by lower interest rates. However, if in fact, they were to dig into the real reason for high loan balances, it would be counter narrative and greatly harm their support base.

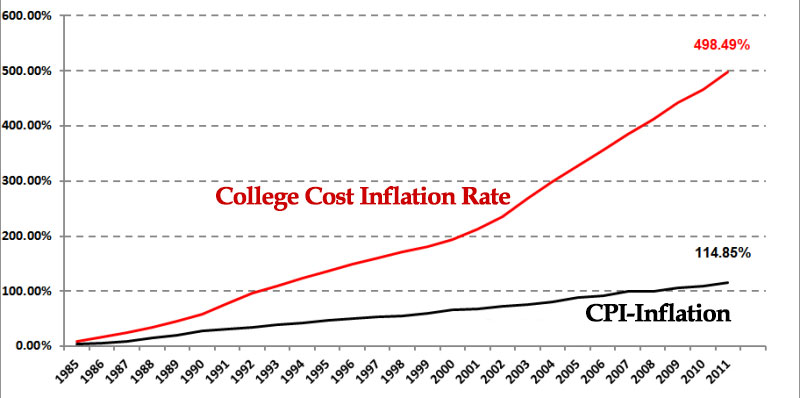

Since 1982 a typical US household income has increased by 147%, much more than government reported inflation, but significantly behind the huge increase in college costs. College costs have been rising roughly at a rate of 7% per year for decades. Since 1985, the overall consumer price index has risen 115% while the college education inflation rate has risen nearly 437%. The real problem is that the cost of college has risen so much faster than incomes and the general consumer price index. Of course, the average person doesn’t understand this when the message they hear from a trusted source is that the wealthy are the problem and further, the wealthy should be paying for their student loans. The greater irony is that the message is delivered by people like Massachusetts Senator, Elizabeth Warren, who earned $700,000 over a two year period as a college professor at Harvard for teaching two hours a week. At the same time, she collected another $165,300 in government salary.

The reality is that the government wants to control the whole economy. After having successfully taking control over healthcare, which comprised about 1/8 of our economy, they now want to complete their control of education. With the public paying for student loans, they would simply represent an entitlement transfer payment from the taxpayer to college professors, who would of course continue teaching students the benefits of big government.

If they are truly concerned about the financial health of America, why don’t we see reports the danger of doubling the national debt and what debt service will look like at nominal interest rates? We know that wars are never paid for, but almost always financed through the sale of treasuries. Thus our national debt is also a matter of national security.

Is income inequality really the primary problem? Then why aren’t they publishing a comparison based on hours worked? Let’s say a College Professor vs. a McDonald’s employee? I suspect you already know. One of the best things you can do for yourselves is to learn how to think critically.