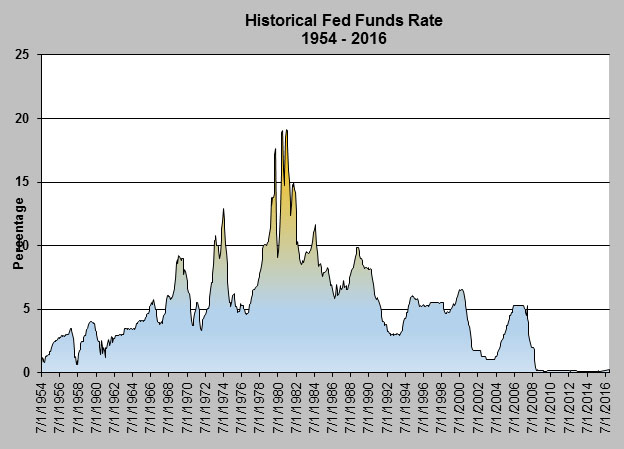

Or maybe the title could be… “Why aren’t we buying bonds?” I could give several lengthy explanations, all of which would center on the problem of government intervention in free markets. It’s enough to know that our trendfollowing model works in spite of the government. That being said, we’ll start with a simple look at historic interest rates. The Federal Funds rate is the overnight lending rate between banks and essentially the base rate for all fixed income price models before the various risk premia are included. Knowing that most eyes will glaze over as I use industry language, I’ll keep this very short and simple. The lower the overnight lending rate is… the lower every other form of interest will be as well.

What is the Net Effect of Low Rates?

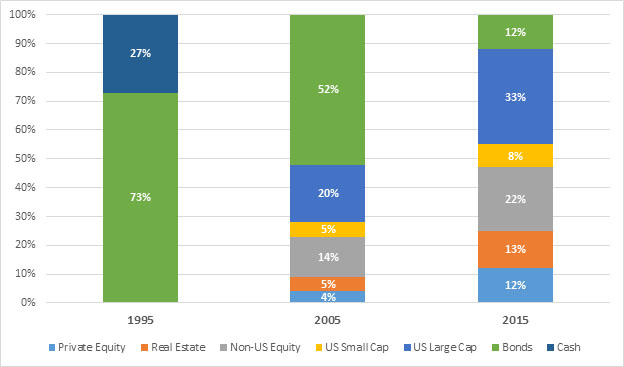

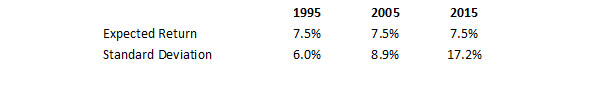

There are two primary effects of low rates, the first is the blend of our allocation necessary to produce returns and the second (a function of the first), is that overall risk increases in the portfolio. In a recent report from Callan Associates, they illustrate the increase in risk required to achieve the same returns over time.

Source: Callan Associates

The bar chart above shows the required allocation for an expected return of 7.5% during various time periods. (The information contained above is for informational purposes only).

Essentially, the Fed has put investors in the position of having to assume higher risk in order to receive what used to be a “normal” return. This move has punished traditional savers and brought a new level of discomfort to those who require income from their investments in order to pay retirement expenses.

The most reasonable response for investors is to utilize an equity strategy the focuses on active risk management. We know of one if you’re interested 😉 The second response is to adjust your thinking about reasonable returns and expected volatility.

Do you own bonds in your portfolio? Tells us about your risk management strategy?